Epica Guide Series

Benefits of Singapore Offshore Company

Refer to this guide to know more about the benefits of establishing Singapore Offshore Company.

Watch the video or read below

Benefits of registering an offshore company in Singapore?

Table of Contents

In this guide we are discussing about a company being incorporated in Singapore by a person or company resident in other jurisdiction. In case you are interested in incorporating an offshore company in jurisdiction like BVI then we have a separate package for the same.

Any company that is incorporated in a jurisdiction other than the jurisdiction where the company’s principal investors reside or one that constitutes its primary place of operations is called an Offshore Company. In layman’s language, offshore means a place or jurisdiction other than the one of your own.

Incorporating an offshore company has several advantages that include ease of company set up, tax benefits, straightforward reporting requirements, and current administration, etc. The most critical decision for offshore company incorporation is the choice of a particular jurisdiction as it can have vital effects on your business. Therefore, Singapore offshore company is a setup that is tax-efficient besides being straightforward and easy to operate in a business-friendly and conducive environment.

This article will give a detailed guide about how and why to incorporate a Singapore offshore company. It will also cover a comprehensive checklist for the incorporation of the Singapore offshore companies.

The key benefits of Incorporating an offshore company in Singapore has a number of benefits, as mentioned below:

Benefits of Setting up Singapore Offshore Company : Lower Tax

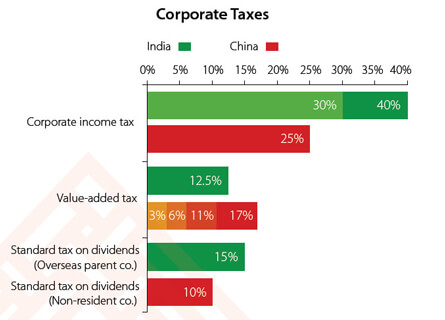

Taxes are one of the biggest reasons that makes Singapore an attraction for businesses and offshore companies. One of the unique advantages that you get in Singapore is its simple tax system with affordable rates and ease of payment. The tax system of Singapore is characterized by the low personal and corporate income tax rates, tax relief measures and tax incentives, absence of dividend tax, absence of capital gains tax, extensive tax treaty network, and a territorial one-tier tax system.

In Singapore, the taxes apply on a territorial basis: therefore, it is applied on the income that is derived by the company from foreign-sourced income or income that is received within Singapore. It is important to note that the foreign-sourced income received in Singapore is exempted from Singapore tax if it meets certain qualifying conditions. Moreover, the foreign-sourced income that is not remitted in Singapore is exempted from the Singapore taxation.

Singapore has a Single Tiered tax system: this implies that once the income at the corporate level has been taxed, its dividends can be distributed totally tax-free to the shareholders.

Please note however that, the dividends while tax free in Singapore, might be subject to tax in your country of residence.

Corporate Income Tax Rates

Benefits of Setting up Singapore Offshore Company - Credibility & Image

The offshore company that is incorporated in Singapore bears an image of credibility and an immediate stature as a legal entity. Merely by incorporating your company in Singapore, your business will earn trust and will be taken seriously by the stakeholders like your bankers, investors, employees, and more importantly by your customers.

Also if your business involves working with overseas partners, then it is much easier to work with those partners through Singapore company rather than the one from your home country.

Benefits of Setting up Singapore Offshore Company - Ease of Incorporation

Singapore is ranked by the World Bank Group in 2018 as the world’s second easiest and most lucrative place to do business. The company registration process is pretty quick, precise, efficient, and free of any bureaucratic red tape. The process of registration is fully computerized and involves just two steps – Company’s name approval and submission of the incorporation documents. These documents can easily be executed online and the whole process of incorporation of Singapore Offshore Company under normal conditions take 1-2 days.

Of course the service provider and the banks will have to do their KYC (Know your customer) procedure as required by professional authorities, but the process is usually quick.

Benefits of Setting up Singapore Offshore Company - 100% Foreign Ownership

The foreign ownership policy in Singapore is quite liberal and open. If you wish to establish an offshore company in Singapore, there are no limitations of the permitted fields of business activity. A complete 100% shareholding in all sectors is allowed, while shareholders can be corporate entities or individuals. In addition to all of this, foreigners are not required to get prior approval from Singapore authorities if they are looking to register an offshore company in Singapore.

Benefits of Setting up Singapore Offshore Company - Stable Political Environment

Singapore has rated Political and Economic Risk Consultancy as Asia’s least Risk country and the most politically stable country in Asia. The Singapore government is noted for its pro-business approach and high integrity. It is often described as pragmatic, rational, corrupt-free, and transparent. Singapore is also characterized by a sound, efficient, and transparent legal system. There are clear-cut laws and regulations pertaining to business, manpower, intellectual property protection, and other commerce-related areas. All of this makes the level of risk involved in establishing and operating an offshore company in Singapore negligible to non-existent.

Benefits of Setting up Singapore Offshore Company - Quality Corporate Banking Facilities

Singapore has emerged in the Asia Pacific region as the leading financial center. Singapore offshore companies have many choices when it comes to opening a corporate business account in Singapore as there are a bunch of local and foreign reputable banks that are functioning in Singapore. These banks offer a range of features that are business-friendly, such as internet banking, credit cards, multi-currency accounts, freedom to move funds across countries, trade financing, and more.

Although while opening a corporate bank account most of the banks ask for the physical presence of the account holder at the time of opening of bank account, however, there are exceptions that can be made depending upon the bank policy and case to case basis. The opening of a bank account in Singapore may take anywhere from 10 – 15 days depending upon the submission of documents required by the back and the diligence undertaken by the bank.

Benefits of Setting up Singapore Offshore Company - Venture Capital and Funding Options

Limited funds to fulfill the business plans and run business activities is one of the primary causes of startups failing within the first few years of incorporation. Therefore, it is vital for you as an entrepreneur to ensure the planning of a robust financial policy while drafting a business plan.

There are a number of options with which you can ensure that your offshore company in Singapore does not suffer an ill fate. Following are the funding sources that you can use to support your Singapore offshore company to propel its business to great heights.

Equity Fundraising

The private equity funding is one of the best and most robust option that you have while you are doing business in Singapore. Singapore Government actively encourages private investors to invest in the country’s startups with numerous tax incentives making Singapore one of the most attractive places for private equity and venture capital activities. So, if you opt to finance your business by selling the equity in your start-up company, you sell a part of your ownership of the company (in shape of shares) for cash investment.

What is essential to know as a potential investor in Singapore is that whatever amount is paid to your investors in the form of dividends on shares will be quite less than what you would pay to service a bank loan in the name of debt financing. In addition, the private equity funding is an important source to fund a start-up that lack the collateral or the creditworthiness to leverage on, for taking large loans for purposes of working capital.

Angel Investors

The investors who not only invest capital but also contribute their business expertise / skills in startups in exchange for a substantial share in the company are called Angel Investors. The angel investors can be active as well as sleeping partner.

So, the angel investors are generally wealthy HNWIs who look for promising companies even with higher risk potential. Your startup should be at the least at a quantum between S$25K to S$100K to win an Angel investor who in turn invest sums in range of S$250K to S$750 K.

Private Funds

The next option is the Private Funds like financial institutions, banks, and investment companies. These sources do not get involved in the business as the main purpose is to get an attractive return in the shape of interest rate ranging from 7 – 12%. Therefore, the businesses that are well settled, generating revenue in high amounts, have a good credit track record, and have a high growth potential can benefit from such resources but not the startups. For small businesses and startups, there are microloan programs initiated by the SINGAPORE Government under the auspices of IE Singapore or Spring Singapore that helps in getting loans from institutions like OCBC, DBS, UOB, and the Standard Chartered Bank.

Venture Capital

Venture Capital is about professional investors who have a more direct role in your business when they invest in your company. They are doing so with the vested interests of their own clients. Venture capitalists offer not only capital but also the expertise and advice if your business needs it. However, it must be noted that venture capitalists are involved in the business for 2 – 5 years, seek a higher rate of return around 25 % as they will have to account for their client’s profit. The popular setups for venture capitalism are those with high growth potential like IT, biotechnology, and nanotechnology with a competitive edge. As compared to the US and Europe, the venture capital industry in Singapore is relatively new and small. It is a common practice for Singapore Government, high net worth individuals and large corporations to set up venture capital funds due to attractive tax incentives and other beneficial government policies. At present, there are more than 100 venture capital firms in Singapore.

Benefits of Setting up Singapore Offshore Company - Singapore a Startup Hub

Singapore is a leading center of business startups in Asia and the world. It offers the expertise and network that are required to serve as your business’s launchpad to the region and beyond. With a top-notch connectivity across the globe and the easy access to top-quality talent, research organizations besides a set of world-class supporting infrastructure and stakeholders, Singapore is a heaven for your business and the offshore company.

You can enjoy excellent funding support, with venture capital (VC) funding increasing steadily beyond US$1 billion. In 2017, Singapore closed US$1.2 billion in VC deals, with investment activities set to remain robust through 2018.

Singapore offers an abundance of opportunities to your business to cooperate and co-innovate with multinational corporations (MNCs) and government agencies with incubation and venture activities. There are international giants like IBM, Accenture, and banks such as UOB and HSBC who have set their innovation hubs in Singapore. Singapore also offers a great source as a reference market and test-bedding hub for the larger Asia Pacific region.

Checklist – Incorporation of Offshore Company in Singapore

If you have made your mind to incorporate your offshore company in Singapore, you are required to do a set of actions that include submission of essential documents as well. We have outlined the whole process in the table given below to give you a fair idea of the steps involved in the incorporation of your offshore company in Singapore.

Actions (What and Who) |

Explanation (How, Why and by Whom) |

| Approval of the name of the offshore company in Singapore | |

| Directors of the Offshore Company | |

| Shareholders of the Offshore Company | |

| Company Secretary of the offshore Company | |

| How much Paid-up Capital is required? | |

| Registered Address of the offshore Company in Singapore | |

| Company's Incorporation Agent - Appointment | |

| What all documents are required for Incorporation of offshore company in Singapore? | |

| What is the process of incorporation of Singapore Offshore Company? | |

| Corporate Bank Account Opening in Singapore | |

| Registration for Tax in Singapore | |

| Acquiring the Permits and Business Licenses | |

| Current Filing and Compliance requirements of Singapore offshore Company | |

| Move to Singapore – Relocation |